Current California Mortgage and Refinance Rates

Table Of Content

And don’t forget to look at the annual percentage rate (APR) for each offer — this will show you the true cost of a given loan, including interest and fees. The rate and monthly payments displayed in this section are for informational purposes only. Payment information does not include applicable taxes and insurance.

How to get the best current mortgage rate

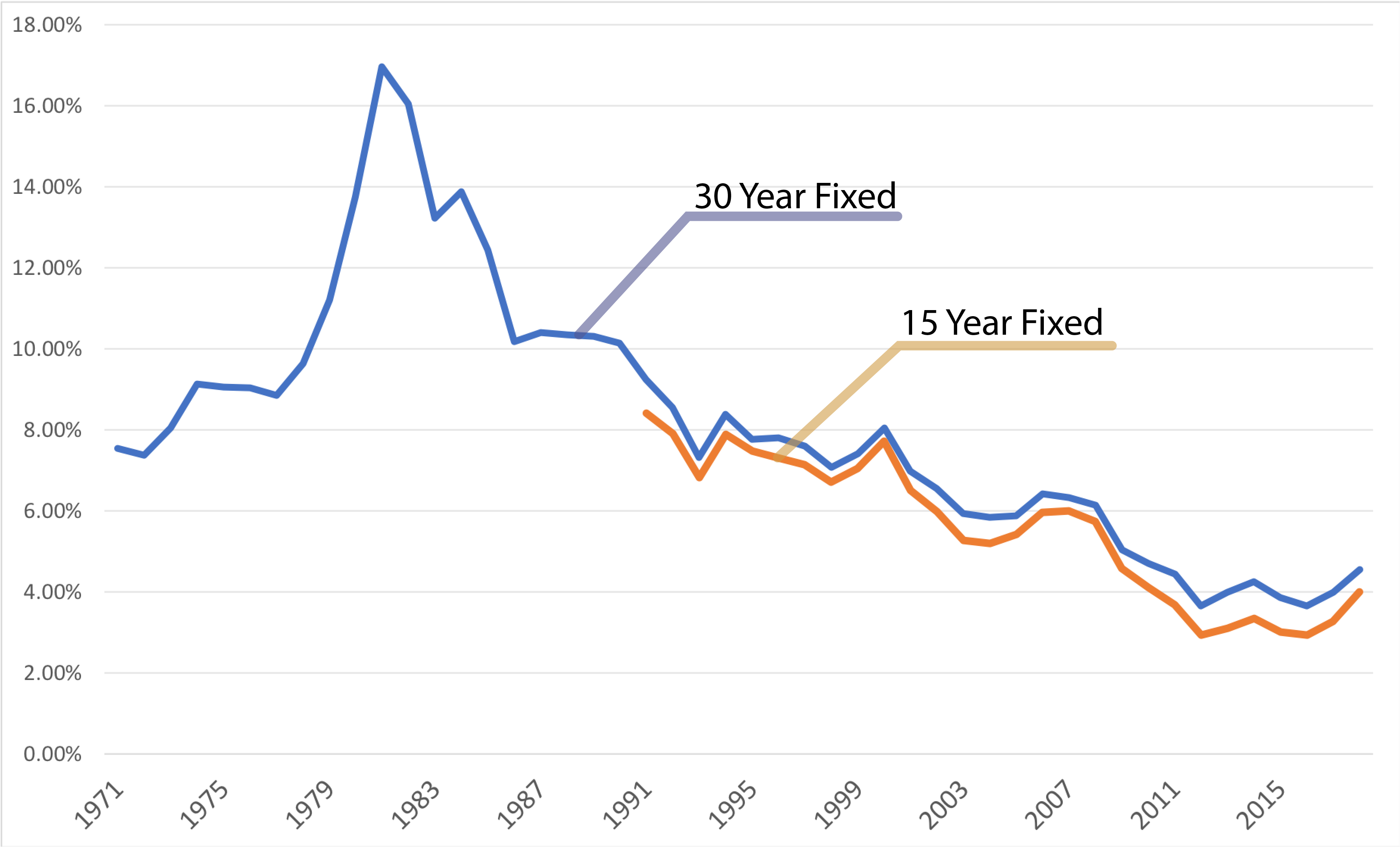

Mortgage Rate History: 1970s to 2023 - Bankrate.com

Mortgage Rate History: 1970s to 2023.

Posted: Mon, 08 Apr 2024 07:00:00 GMT [source]

However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection. Use a mortgage calculator to figure out how changing interest rates might affect you. The current average is 0.25% APY for a high-yield account with a $25,000 minimum deposit. On high-yield accounts requiring a minimum deposit of $10,000, today’s best interest rate is 5.35%.

Learn About Mortgages

"Meaningful gains will only occur with declining mortgage rates and rising inventory." Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice. Mortgage, home equity and credit products are offered by U.S. If your details closely match those used to calculate today’s rates, possibly.

Mortgage Rates Today: April 24, 2024—Rates Remain Fairly Steady

Going with the lowest rate might seem smart, given how much interest you pay over the life of a mortgage. But getting the right mortgage for your situation is also important. We focus first on understanding you and your goals, not just your finances. Advertisements often assume a credit score of 740 or higher.

Many homeowners have taken the opportunity to refinance in this low rate environment, and it isn't too late to do so. For whatever reason, borrowers sometimes choose not to refinance when it is in their best interest to do so. So, homeowners should definitely take the time to compare their existing mortgage rate and see if they can do better. Homeowners need to shop around to look for the best mortgage deal possible. Unfortunately, although the home is the most important asset and the mortgage is the most important liability for most households, research has shown that homebuyers do not do enough shopping. Comparing rates and fees from several lenders is important, not only from traditional lenders such as local banks, but also Fintech lenders.

Fixed-rate mortgage

That doesn’t mean you can’t get a lower rate than what you currently have, but there is room to improve your score and boost your savings. Before you apply for a mortgage refinance, check your credit score and get a copy of your credit report. The term is the amount of time you have to pay back the loan. The numbers shown (for example, 10/1 or 10/6) represent the fixed-rate period (10 years) and the adjustment period of the variable rate (either every year or every six months).

Fed Holds Rates Steady, Again: What This Means for Mortgage Rates in 2024

The table below is updated daily with current mortgage rates for the most common types of home loans. In addition to monetary policy, lenders also have an impact on mortgage rates. A lender with physical locations and a lot of overhead may charge higher interest rates to cover its operating costs and make a profit on its mortgage business. On the other hand, lenders that operate solely online, tend to offer lower mortgage rates because they have less fixed costs to cover.

Keep Your Loan-to-Value Ratio Low

The 30-year fixed-rate mortgage is 18 basis points higher than one week ago and 103 basis points higher than one year ago. A lot of lenders will require an appraisal during the mortgage process to determine the fair market value of a property. This ensures you’re not paying more for a home than it’s worth on a purchase transaction and verifies the amount of equity available on a refinance transaction. Home values are constantly changing depending on buyer demand and the local market. Contact a California lender to learn more about local requirements for mortgages. Mortgage closing costs usually range anywhere from 2% to 6% of your total home loan amount.

Meanwhile, many borrowers are sitting on the historically low mortgage rates they nabbed during the pandemic. Those rock-bottom rates are unlikely to return anytime soon—if at all—resulting in limited motivation for many homeowners to refinance. By the end of March, the average 30-year fixed rate of 6.79% was close to half a percentage point higher than the same week a year ago, and refinance rates tend to be higher than purchase rates. In a widely expected move, the Federal Open Market Committee (FOMC) voted unanimously to leave the benchmark federal funds rate unchanged after its two-day March meeting.

To protect your credit, make all your applications within a two-week window. When you apply for a loan (or pre-approval), the lender does a hard credit check or hard inquiry. Hard inquiries can take points off your credit score, but there's a way to shop around for a mortgage without harming your credit.

To help you find the right one for your needs, use this tool to compare lenders based on a variety of factors. Bankrate has reviewed and partners with these lenders, and the two lenders shown first have the highest combined Bankrate Score and customer ratings. You can use the drop downs to explore beyond these lenders and find the best option for you. While the policymaker doesn't directly set mortgage rates, its decisions do influence their direction.

Mortgage rates are influenced by several factors, including how the bond market reacts to the Fed’s interest rate policy and the moves in the 10-year Treasury yield, which lenders use as a guide to pricing home loans. Borrowers with FHA loans must refinance into a conventional loan in order to get rid of their mortgage insurance premium, which can save hundreds or thousands of dollars per year. Mortgage refinance rates vary by lenders based on a whole host of different factors. Some lenders might charge lower rates because they need more business and are able to take on more risk, for example. Likewise, lenders have different qualifications for getting low rates.

ARM rates, APRs and monthly payments are subject to increase after the initial fixed-rate period of five, seven, or 10 years and assume a 30-year term. The rates and monthly payments shown are based on a loan amount of $464,000 and a down payment of at least 25%. Learn more about how these rates, APRs and monthly payments are calculated. Plus, see a conforming fixed-rate estimated monthly payment and APR example.

Comments

Post a Comment